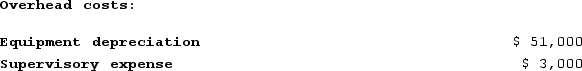

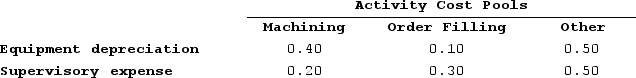

Goertz Corporation has an activity-based costing system with three activity cost pools--Machining, Order Filling, and Other. In the first stage allocations, costs in the two overhead accounts, equipment depreciation and supervisory expense, are allocated to the three activity cost pools based on resource consumption. Data used in the first stage allocations follow:  Distribution of Resource Consumption Across Activity Cost Pools:

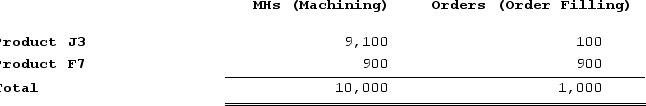

Distribution of Resource Consumption Across Activity Cost Pools: Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:Activity:

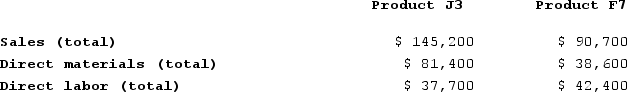

Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:Activity: Finally, the costs of Machining and Order Filling are combined with the following sales and direct cost data to determine product margins.Sales and Direct Cost Data:

Finally, the costs of Machining and Order Filling are combined with the following sales and direct cost data to determine product margins.Sales and Direct Cost Data: What is the overhead cost assigned to Product F7 under activity-based costing?

What is the overhead cost assigned to Product F7 under activity-based costing?

Definitions:

Legislative Acts

Laws enacted by a governmental legislative body.

Uniform Statute

A law that is adopted by all states in the United States to bring consistency across state lines in areas where national uniformity is deemed beneficial.

State Legislature

The legislative branch of state government in the United States, responsible for making and passing laws at the state level.

Independent Federal Administrative Agency

A government agency that operates independently of the executive branch, often established by Congress to regulate and oversee specific areas of public administration.

Q3: The LFH Corporation makes and sells a

Q12: Mirabile Corporation uses activity-based costing to compute

Q136: When preparing a direct materials budget, beginning

Q150: Harrti Corporation has budgeted for the following

Q234: Doede Corporation uses activity-based costing to compute

Q283: Lubinsky Corporation is an oil well service

Q318: An activity rate of $512 per product

Q319: Jahnel Corporation is conducting a time-driven activity-based

Q323: Heyl Corporation is conducting a time-driven activity-based

Q366: Keyser Corporation, which has only one product,