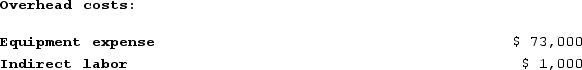

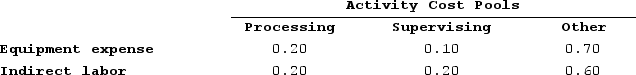

Addleman Corporation has an activity-based costing system with three activity cost pools--Processing, Supervising, and Other. In the first stage allocations, costs in the two overhead accounts, equipment expense and indirect labor, are allocated to the three activity cost pools based on resource consumption. Data used in the first stage allocations follow:  Distribution of Resource Consumption Across Activity Cost Pools:

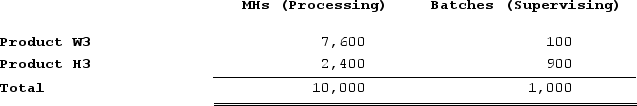

Distribution of Resource Consumption Across Activity Cost Pools: Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:Activity:

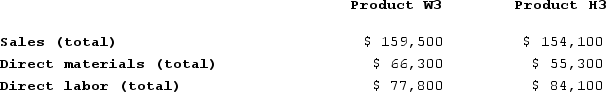

Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:Activity: Finally, the costs of Processing and Supervising are combined with the following sales and direct cost data to determine product margins.Sales and Direct Cost Data:

Finally, the costs of Processing and Supervising are combined with the following sales and direct cost data to determine product margins.Sales and Direct Cost Data: What is the product margin for Product H3 under activity-based costing?

What is the product margin for Product H3 under activity-based costing?

Definitions:

Unrelated Year-end Adjustments

Adjustments made to the financial statements at year-end that do not pertain to the normal operations of the business.

Prepaid Insurance

An asset account representing payments made for insurance coverage before the coverage period.

Accrued Salaries

Salaries that have been incurred but not yet paid; an expense that represents the amount of salary earned by employees but not disbursed by the end of the accounting period.

Unearned Rent

Income received for renting out property that has not yet been earned because the rental period has not occurred.

Q57: In a Cost Analysis report in time-based

Q100: Morine Corporation is conducting a time-driven activity-based

Q107: Weldon Corporation has provided the following data

Q164: The master budget consists of a number

Q190: Organization-sustaining activities are carried out regardless of

Q211: Farris Corporation, which has only one product,

Q282: Gusler Corporation makes one product and has

Q347: Keyser Corporation, which has only one product,

Q351: Departmental overhead rates may not correctly assign

Q432: Bickel Corporation uses customers served as its