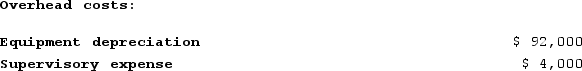

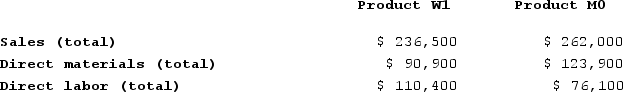

Doede Corporation uses activity-based costing to compute product margins. In the first stage, the activity-based costing system allocates two overhead accounts--equipment depreciation and supervisory expense--to three activity cost pools--Machining, Order Filling, and Other--based on resource consumption. Data to perform these allocations appear below:  Distribution of Resource Consumption Across Activity Cost Pools:

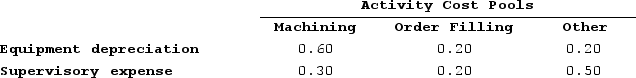

Distribution of Resource Consumption Across Activity Cost Pools: In the second stage, Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products.Activity:

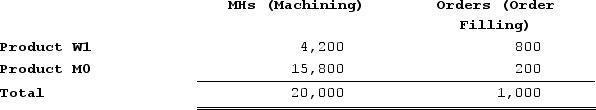

In the second stage, Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products.Activity: Finally, sales and direct cost data are combined with Machining and Order Filling costs to determine product margins.Sales and Direct Cost Data:

Finally, sales and direct cost data are combined with Machining and Order Filling costs to determine product margins.Sales and Direct Cost Data: How much overhead cost is allocated to the Machining activity cost pool under activity-based costing in the first stage of allocation?

How much overhead cost is allocated to the Machining activity cost pool under activity-based costing in the first stage of allocation?

Definitions:

Q15: Bonkowski Corporation makes one product and has

Q21: When sales exceed production and the company

Q163: Annika Company uses activity-based costing. The company

Q192: Under variable costing, only variable production costs

Q233: Addleman Corporation has an activity-based costing system

Q250: Fuson Corporation makes one product and has

Q282: Angara Corporation uses activity-based costing to determine

Q290: Pierceall Corporation is conducting a time-driven activity-based

Q343: Orick Enterprises makes a variety of products

Q369: Krueger Corporation is conducting a time-driven activity-based