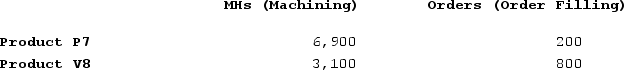

Reck Corporation uses activity-based costing to assign overhead costs to products. Overhead costs have already been allocated to the company's three activity cost pools as follows: Machining, $11,700; Order Filling, $17,800; and Other, $13,500. Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Activity data appear below:  What is the overhead cost assigned to Product V8 under activity-based costing? Garrison 16e Rechecks 2018-07-24

What is the overhead cost assigned to Product V8 under activity-based costing? Garrison 16e Rechecks 2018-07-24

Definitions:

Employment Standards

Legal requirements that establish the minimum conditions for working hours, wages, benefits, and working conditions that employers must provide to employees.

Implied Contract

An unwritten agreement created through the actions, behavior, or circumstances of the parties involved, rather than explicit words.

Code of Conduct

A set of rules outlining the social norms, responsibilities, and proper practices for an individual or organization.

Discriminatory Wages

Wages that are set based on biased or unjust grounds, often resulting in unequal pay for employees who perform similar tasks.

Q10: The controller of Hendershot Corporation estimates the

Q16: Acti Manufacturing Corporation is estimating the following

Q42: Bonkowski Corporation makes one product and has

Q59: EMD Corporation manufactures two products, Product S

Q158: Bitonti Corporation has provided the following data

Q180: The manufacturing overhead budget at Franklyn Corporation

Q186: Choi Corporation is conducting a time-driven activity-based

Q304: Aaron Corporation, which has only one product,

Q322: Leaper Corporation uses an activity-based costing system

Q337: Designing a new backpack at an outdoor