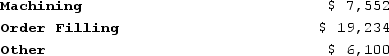

Handal Corporation uses activity-based costing to compute product margins. Overhead costs have already been allocated to the company's three activity cost pools--Machining, Order Filling, and Other. The costs in those activity cost pools appear below:  Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Activity data appear below:

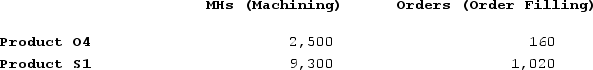

Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Activity data appear below: Finally, sales and direct cost data are combined with Machining and Order Filling costs to determine product margins.

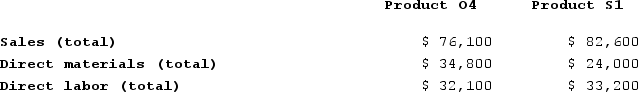

Finally, sales and direct cost data are combined with Machining and Order Filling costs to determine product margins. What is the overhead cost assigned to Product S1 under activity-based costing? (Round the Intermediate calculation to two decimal places and your final answer to nearest whole dollar.)

What is the overhead cost assigned to Product S1 under activity-based costing? (Round the Intermediate calculation to two decimal places and your final answer to nearest whole dollar.)

Definitions:

Leadership Approach

A method or strategy adopted by a leader to guide and influence the behavior of followers toward achieving certain objectives.

Leader-Member Exchange

A theory describing the dyadic relationship between leaders and followers, focusing on the quality of their interactions and its impact on performance.

Behavioral Approach

A perspective in psychology focusing on observable behaviors and the ways they're learned.

Reassuring Authority Figure

An individual in a position of power who instills confidence and calmness through supportive and positive guidance.

Q3: The LFH Corporation makes and sells a

Q79: Bramble Corporation is a small wholesaler of

Q114: Depasquale Corporation is working on its direct

Q137: Jarvis Corporation is conducting a time-driven activity-based

Q184: Ledonne Corporation is conducting a time-driven activity-based

Q185: Marst Corporation's budgeted production in units and

Q255: Abel Corporation uses activity-based costing. The company

Q262: Bernosky Corporation is conducting a time-driven activity-based

Q272: Neas Corporation has an activity-based costing system

Q366: Deemer Corporation has an activity-based costing system