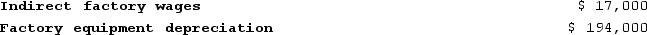

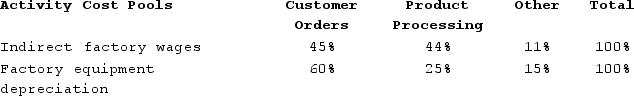

Beckley Corporation has provided the following data from its activity-based costing accounting system:

Distribution of Resource Consumption across Activity Cost Pools:

Distribution of Resource Consumption across Activity Cost Pools:

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs that are not assigned to products.Required:a. Determine the total amount of indirect factory wages and factory equipment depreciation costs that would be allocated to the Product Processing activity cost pool.b. Determine the total amount of indirect factory wages and factory equipment depreciation costs that would NOT be assigned to products.

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs that are not assigned to products.Required:a. Determine the total amount of indirect factory wages and factory equipment depreciation costs that would be allocated to the Product Processing activity cost pool.b. Determine the total amount of indirect factory wages and factory equipment depreciation costs that would NOT be assigned to products.

Definitions:

Q22: Time-based activity-based costing does NOT use which

Q29: Wyrich Corporation has two divisions: Blue Division

Q85: Roberts Enterprises has budgeted sales in units

Q94: Vito Corporation manufactures two products: Product F77I

Q140: Sevenbergen Corporation makes one product and has

Q266: Leheny Corporation manufactures and sells one product.

Q279: Carriveau Corporation has two divisions: Consumer Division

Q287: Nissley Wedding Fantasy Corporation makes very elaborate

Q302: Wyrich Corporation has two divisions: Blue Division

Q346: Aaron Corporation, which has only one product,