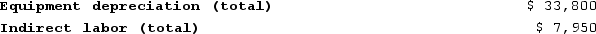

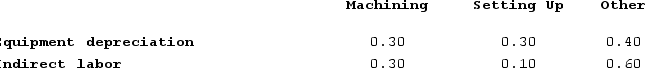

Howell Corporation's activity-based costing system has three activity cost pools--Machining, Setting Up, and Other. The company's overhead costs, which consist of equipment depreciation and indirect labor, are allocated to the cost pools in proportion to the activity cost pools' consumption of resources.

Distribution of Resource Consumption Across Activity Cost Pools

Distribution of Resource Consumption Across Activity Cost Pools

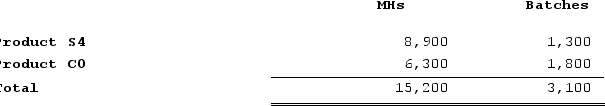

Costs in the Machining cost pool are assigned to products based on machine-hours (MHs) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products.

Costs in the Machining cost pool are assigned to products based on machine-hours (MHs) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products.

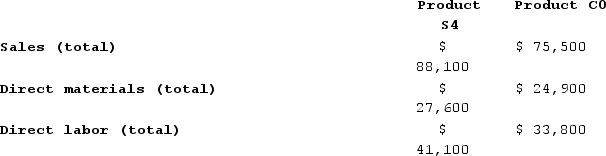

Additional data concerning the company's products appears below:

Additional data concerning the company's products appears below:

Required:a. Assign overhead costs to activity cost pools using activity-based costing. b. Calculate activity rates for each activity cost pool using activity-based costing. c. Determine the amount of overhead cost that would be assigned to each product using activity-based costing. d. Determine the product margins for each product using activity-based costing.

Required:a. Assign overhead costs to activity cost pools using activity-based costing. b. Calculate activity rates for each activity cost pool using activity-based costing. c. Determine the amount of overhead cost that would be assigned to each product using activity-based costing. d. Determine the product margins for each product using activity-based costing.

Definitions:

Nominal Wages

The wages paid to employees measured in current money, without adjustment for inflation or purchasing power.

Price Level

An index that measures the average level of prices of goods and services in an economy over a period of time.

Real Wages

Wages adjusted for inflation, reflecting the true purchasing power of income received by workers.

Nominal Income

The amount of money earned in current dollars, without adjustment for inflation, affecting purchasing power over time.

Q6: The Bandeiras Corporation, a merchandising firm, has

Q124: Nelter Corporation, which has only one product,

Q132: Wala Incorporated bases its selling and administrative

Q144: Azuki Corporation operates in two sales territories,

Q151: The Carlsbad Corporation produces and markets two

Q222: When reconciling variable costing and absorption costing

Q233: Tubaugh Corporation has two major business segments--East

Q250: Dallavalle Corporation manufactures and sells one product.

Q253: In activity-based costing, as in traditional costing

Q304: Lindenmuth Corporation is conducting a time-driven activity-based