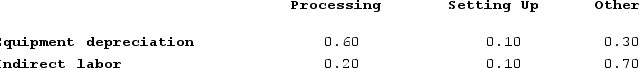

Moorman Corporation has an activity-based costing system with three activity cost pools--Processing, Setting Up, and Other. The company's overhead costs consist of equipment depreciation and indirect labor and are allocated to the cost pools in proportion to the activity cost pools' consumption of resources. Equipment depreciation totals $53,000 and indirect labor totals $3,000. Data concerning the distribution of resource consumption across activity cost pools appear below:

Required:Assign overhead costs to activity cost pools using activity-based costing.

Required:Assign overhead costs to activity cost pools using activity-based costing.

Definitions:

Big Five Traits

A model describing five major dimensions of human personality: Openness, Conscientiousness, Extraversion, Agreeableness, and Neuroticism.

Living Longer

The result of various factors such as genetics, lifestyle choices, and advances in medical care that contribute to an increase in life expectancy.

Self-Control

The ability of an individual to regulate their emotions, thoughts, and behaviors in the face of temptations and impulses.

Sweets

Food items that are rich in sugar and often used as a treat or dessert.

Q90: Neef Corporation has provided the following data

Q92: Ieso Corporation has two stores: J and

Q98: Weimar Corporation is conducting a time-driven activity-based

Q158: Bitonti Corporation has provided the following data

Q208: Combe Corporation has two divisions: Alpha and

Q237: Data for January for Bondi Corporation and

Q303: Angara Corporation uses activity-based costing to determine

Q307: A company with high operating leverage will

Q338: WV Construction has two divisions: Remodeling and

Q342: Which of the following is an assumption