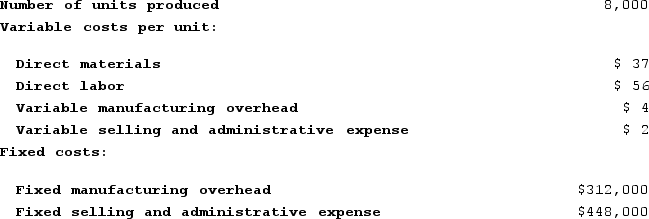

Beamish Incorporated, which produces a single product, has provided the following data for its most recent month of operations:  There were no beginning or ending inventories. The absorption costing unit product cost was:

There were no beginning or ending inventories. The absorption costing unit product cost was:

Definitions:

Compensation Contracts

Agreements specifying the terms of pay and benefits for an employee or executive, which may include salary, bonuses, stock options, and other forms of compensation.

Accounting Standards Codification

The collection and organization of the authoritative accounting and reporting standards for U.S. GAAP (Generally Accepted Accounting Principles).

GAAP

Generally Accepted Accounting Principles; a collection of commonly followed accounting rules and standards for financial reporting in the United States.

FASB

The Financial Accounting Standards Board, which is responsible for establishing and improving standards of financial accounting and reporting for the private sector in the United States.

Q28: Hails Corporation manufactures two products: Product Q21F

Q35: An activity-based costing system that is designed

Q59: EMD Corporation manufactures two products, Product S

Q122: Bries Corporation is preparing its cash budget

Q125: Nuzum Corporation has two divisions: Division M

Q229: All differences between super-variable costing and variable

Q277: Mckissic Corporation has two divisions: Domestic and

Q290: Awtis Corporation has a margin of safety

Q366: Deemer Corporation has an activity-based costing system

Q371: Desilets Corporation has provided the following data