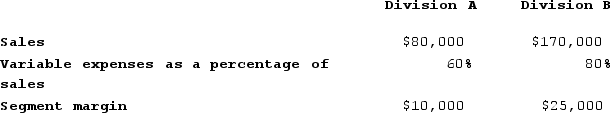

Eyestone Corporation has two divisions, A and B. The following data pertain to operations in October:  If common fixed expenses were $17,000, total fixed expenses were:

If common fixed expenses were $17,000, total fixed expenses were:

Definitions:

Actual Direct Labour Rate

The real wage rate paid for the hours that direct laborers work, differing from initially estimated or standard rates.

Standard Direct Labour Rate

The pre-established amount paid per unit of work or hour of labor to employees directly involved in manufacturing.

Materials Price Variance

A financial metric measuring the deviation between the budgeted or standard cost of materials and the actual cost incurred.

Variable Manufacturing Overhead Cost Incurred

The total variable costs that have been spent during a particular period for activities related to manufacturing overhead.

Q76: Sufra Corporation is planning to sell 100,000

Q131: Cadavieco Corporation has provided the following data

Q139: Wolanski Corporation has provided the following data

Q188: Which of the following would be classified

Q193: Tremble Corporation manufactures and sells one product.

Q234: Valcarcel Corporation manufactures and sells one product.

Q317: Neef Corporation has provided the following data

Q354: Ferrar Corporation has two major business segments:

Q361: Creswell Corporation's fixed monthly expenses are $30,000

Q371: Jemmott Corporation has two divisions: Western Division