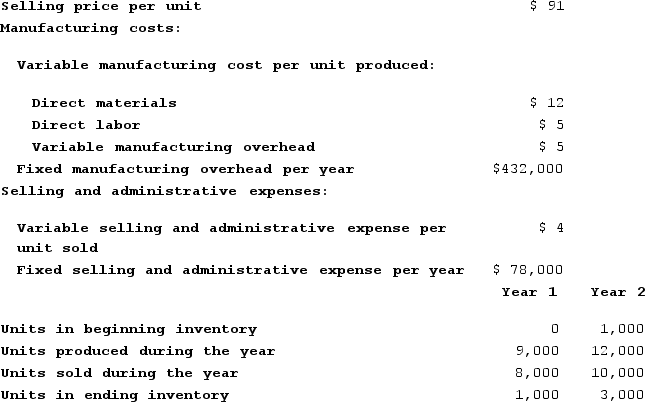

Cahalane Corporation has provided the following data for its two most recent years of operation:  Which of the following statements is true for Year 2

Which of the following statements is true for Year 2

Definitions:

Option

A financial derivative that gives the buyer the right, but not the obligation, to buy or sell an underlying asset or instrument at a specified strike price prior to or on a specified date.

Gamma

A measure of the rate of change of an option's delta in relation to the underlying asset's price.

Risk-Free Rate

The theoretical return on investment with no risk of financial loss, typically associated with government bonds.

American Call Option

A type of options contract that gives the holder the right, but not the obligation, to buy a specified amount of an underlying asset at a predetermined price before or at the option's expiration.

Q92: Code Corporation is conducting a time-driven activity-based

Q93: Valdez Corporation has provided the following contribution

Q97: Absorption costing treats all fixed costs as

Q114: Eyestone Corporation has two divisions, A and

Q155: Aresco Corporation manufactures two products: Product G51B

Q198: Janos Corporation, which has only one product,

Q290: Pierceall Corporation is conducting a time-driven activity-based

Q323: Heyl Corporation is conducting a time-driven activity-based

Q345: Last year, Rasband Corporation's variable costing net

Q365: Net operating income computed using absorption costing