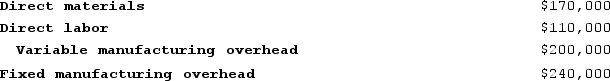

Krepps Corporation produces a single product. Last year, Krepps manufactured 20,000 units and sold 15,000 units. Production costs for the year were as follows:  Sales totaled $825,000 for the year, variable selling and administrative expenses totaled $108,000, and fixed selling and administrative expenses totaled $165,000. There was no beginning inventory. Assume that direct labor is a variable cost.The contribution margin per unit was:

Sales totaled $825,000 for the year, variable selling and administrative expenses totaled $108,000, and fixed selling and administrative expenses totaled $165,000. There was no beginning inventory. Assume that direct labor is a variable cost.The contribution margin per unit was:

Definitions:

Interpersonal Trust

The confidence or belief in the reliability, integrity, and abilities of others on a personal level.

Pre-negotiation Planning

The process of preparing strategies, goals, and objectives before entering into negotiation talks.

Superior Negotiators

Individuals who possess exceptional skills in reaching agreements between parties for mutual benefit.

Common Ground

Shared interests, values, or beliefs that enable parties in a negotiation or dispute to find mutual agreement.

Q52: Smidt Corporation has provided the following data

Q99: Moyas Corporation sells a single product for

Q155: Aresco Corporation manufactures two products: Product G51B

Q225: A company that makes organic fertilizer has

Q229: All differences between super-variable costing and variable

Q247: Baraban Corporation has provided the following data

Q255: Abel Corporation uses activity-based costing. The company

Q293: Janos Corporation, which has only one product,

Q310: Tubaugh Corporation has two major business segments--East

Q327: Data concerning Sinisi Corporation's single product appear