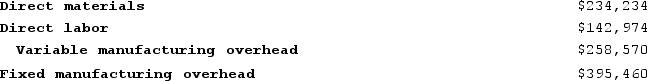

Krepps Corporation produces a single product. Last year, Krepps manufactured 30,420 units and sold 24,900 units. Production costs for the year were as follows:  Sales totaled $1,207,650 for the year, variable selling and administrative expenses totaled $136,950, and fixed selling and administrative expenses totaled $185,562. There was no beginning inventory. Assume that direct labor is a variable cost.Under absorption costing, the ending inventory for the year would be valued at:

Sales totaled $1,207,650 for the year, variable selling and administrative expenses totaled $136,950, and fixed selling and administrative expenses totaled $185,562. There was no beginning inventory. Assume that direct labor is a variable cost.Under absorption costing, the ending inventory for the year would be valued at:

Definitions:

List Price

The manufacturer's suggested retail price or the price at which a product is commonly sold to the public.

Markdown

is a reduction in the selling price of goods, often to clear old stock or respond to reduced demand.

Net Sales

The amount of sales revenue remaining after deducting returns, allowances for damaged or missing goods, and discounts.

Calculate

To determine mathematically the amount or number of something.

Q65: Caraco Corporation has provided the following production

Q120: Thomason Corporation has provided the following contribution

Q130: Croft Corporation produces a single product. Last

Q196: Davitt Corporation produces a single product and

Q199: A tile manufacturer has supplied the following

Q214: A manufacturer of tiling grout has supplied

Q244: Kray Incorporated, which produces a single product,

Q287: When computing the break even for a

Q300: Carroll Corporation has two products, Q and

Q343: Cassius Corporation has provided the following contribution