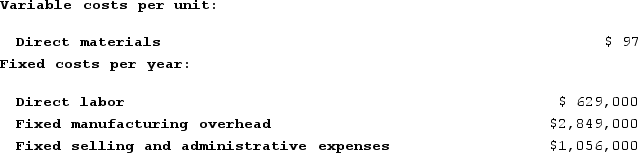

Buckbee Corporation manufactures and sells one product. The following information pertains to the company's first year of operations:  The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 37,000 units and sold 32,000 units. The company's only product is sold for $261 per unit.Assume that the company uses a variable costing system that assigns $17 of direct labor cost to each unit that is produced. The unit product cost under this costing system is:

The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 37,000 units and sold 32,000 units. The company's only product is sold for $261 per unit.Assume that the company uses a variable costing system that assigns $17 of direct labor cost to each unit that is produced. The unit product cost under this costing system is:

Definitions:

Standard Price

The predetermined cost at which goods or services should be purchased or sold, often used as a benchmark for evaluating actual costs.

Actual Price

The genuine cost at which a transaction has occurred or will occur, without any adjustments or discounts.

Overhead Variance

The difference between the actual overhead incurred and the overhead allocated to production during a given period.

Flexible Budget

A projection of budget data for various levels of activity.

Q35: Mason Corporation's selling price was $20 per

Q68: Nurre Corporation manufactures and sells one product.

Q100: Morine Corporation is conducting a time-driven activity-based

Q126: Ingrum Corporation produces and sells two products.

Q151: The Carlsbad Corporation produces and markets two

Q218: The R <sup>2</sup> (i.e., R-squared) tells us

Q234: Golebiewski Corporation has provided the following contribution

Q253: Bertie Corporation has two divisions: Retail Division

Q321: Mancine Corporation has provided the following contribution

Q385: Toxemia Salsa Corporation manufactures five flavors of