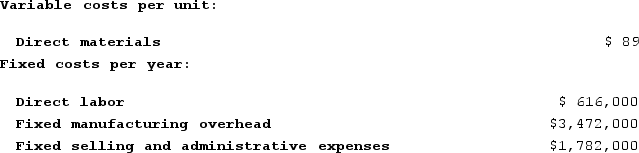

Letcher Corporation manufactures and sells one product. The following information pertains to the company's first year of operations:  The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 56,000 units and sold 54,000 units. The company's only product is sold for $227 per unit.The company is considering using either super-variable costing or a variable costing system that assigns $11 of direct labor cost to each unit that is produced. Which of the following statements is true regarding the net operating income in the first year?

The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 56,000 units and sold 54,000 units. The company's only product is sold for $227 per unit.The company is considering using either super-variable costing or a variable costing system that assigns $11 of direct labor cost to each unit that is produced. Which of the following statements is true regarding the net operating income in the first year?

Definitions:

Marginal Cost

The financial cost of producing an extra unit of a good or service.

Average Total Cost

The total cost of production divided by the quantity of output produced.

Average Variable Cost

Represents the cost that varies with the level of output, calculated by dividing the variable costs by the quantity produced.

Marginal Cost Curve

A graphical representation showing how the cost of producing one additional unit changes as production volume increases.

Q35: Younie Corporation has two divisions: the South

Q110: Neef Corporation has provided the following data

Q113: Dukelow Corporation has two divisions: the Governmental

Q148: Neef Corporation has provided the following data

Q179: Labadie Corporation manufactures and sells one product.

Q227: J Corporation has two divisions. Division A

Q270: A soft drink bottler incurred the following

Q285: Kelsay Corporation has provided the following contribution

Q308: Kelsay Corporation has provided the following contribution

Q353: Lacourse Incorporated's inspection costs are listed below: