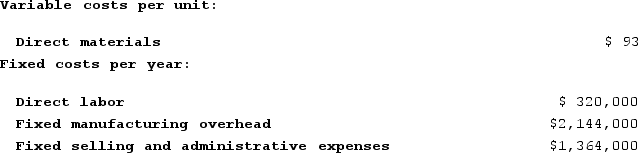

Dallavalle Corporation manufactures and sells one product. The following information pertains to the company's first year of operations:  The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 32,000 units and sold 31,000 units. The company's only product is sold for $238 per unit.The unit product cost under super-variable costing is:

The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 32,000 units and sold 31,000 units. The company's only product is sold for $238 per unit.The unit product cost under super-variable costing is:

Definitions:

Intrinsic Value

The actual, fundamental value of an asset, based on underlying perceptions of its true value including all aspects of the business, in terms of both tangible and intangible factors.

Call Option

A financial contract giving the buyer the right, but not the obligation, to purchase a stock or other asset at a set price within a specific time period.

Hedge Ratio

A ratio used to measure the proportion of an investment's risk that is being mitigated by a hedge, aiming to reduce potential losses.

At-the-money

A term used in options trading to describe an option where the market price of the underlying asset is equal to the option's strike price.

Q22: Time-based activity-based costing does NOT use which

Q62: Moskowitz Corporation has provided the following data

Q64: Break-even analysis assumes that:<br>A) Total revenue is

Q166: Daston Company manufactures two products, Product F

Q178: Krepps Corporation produces a single product. Last

Q218: The R <sup>2</sup> (i.e., R-squared) tells us

Q243: Pacius Corporation is conducting a time-driven activity-based

Q265: Ieso Corporation has two stores: J and

Q346: The accounting department of Archer Company, a

Q370: Flesch Corporation produces and sells two products.