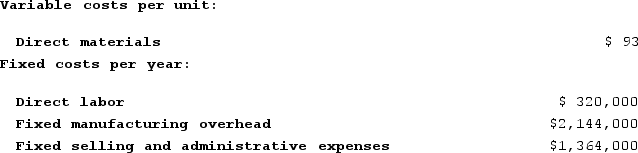

Dallavalle Corporation manufactures and sells one product. The following information pertains to the company's first year of operations:  The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 32,000 units and sold 31,000 units. The company's only product is sold for $238 per unit.Assume that the company uses a variable costing system that assigns $10 of direct labor cost to each unit that is produced. The unit product cost under this costing system is:

The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 32,000 units and sold 31,000 units. The company's only product is sold for $238 per unit.Assume that the company uses a variable costing system that assigns $10 of direct labor cost to each unit that is produced. The unit product cost under this costing system is:

Definitions:

Financial Statements

Official documentation of a business, individual, or entity's financial condition and operations, normally comprising the income statement, balance sheet, and statement of cash flows.

Statement of Cash Flows

A financial statement that shows how changes in balance sheet accounts and income affect cash and cash equivalents, dividing activities into operating, investing, and financing.

Statement of Stockholders' Equity

A financial statement that shows changes in the value of a company’s equity over a specified period.

Income Statement

The income statement is a financial document that reports a company's financial performance over a particular period, showing revenues, expenses, and net income or loss.

Q2: When unit sales are constant, but the

Q122: Uchimura Corporation has two divisions: the AFE

Q133: Data concerning Pellegren Corporation's single product appear

Q173: Sipho Corporation manufactures a single product. Last

Q187: Meade Nuptial Bakery makes very elaborate wedding

Q209: Nussbaum Corporation has provided the following contribution

Q262: Bernosky Corporation is conducting a time-driven activity-based

Q285: Kelsay Corporation has provided the following contribution

Q308: Kelsay Corporation has provided the following contribution

Q374: Maruca Corporation has provided the following contribution