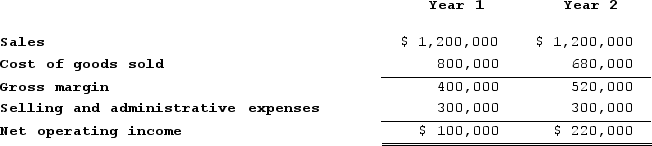

Miller Corporation produces a single product. The company had the following results for its first two years of operation:

In Year 1, the company produced and sold 40,000 units of its only product; in Year 2, the company again sold 40,000 units, but increased production to 50,000 units. The company's variable production cost is $5 per unit and its fixed manufacturing overhead cost is $600,000 a year. Fixed manufacturing overhead costs are applied to the product on the basis of each year's unit production (i.e., a new fixed manufacturing overhead rate is computed each year). Variable selling and administrative expenses are $2 per unit sold.

Required:

a.Compute the unit product cost for each year under absorption costing and under variable costing.

b. Prepare a contribution format income statement for each year using variable costing.

c. Reconcile the variable costing and absorption costing income figures for each year.

d. Explain why the net operating income for Year 2 under absorption costing was higher than the net operating income for Year 1, although the same number of units were sold in each year.

Definitions:

Withdrawal

The act of retreating or pulling back, often used in context of avoiding situations or reducing organizational involvement as a response to dissatisfaction.

Aggression

Aggression encompasses behaviors or attitudes that are hostile, destructive, or violent, often resulting from frustration or conflict.

Procedural Justice

The fairness and transparency of the processes that lead to outcomes or decisions, affecting perceptions of fairness.

Interpersonal Conduct

The behavior and manner in which individuals interact with each other, especially within professional contexts.

Q10: Northern Pacific Fixtures Corporation sells a single

Q34: The Blaine Corporation is a highly automated

Q34: Fleisher Corporation is conducting a time-driven activity-based

Q68: EMD Corporation manufactures two products, Product S

Q78: To estimate what the profit will be

Q112: A company makes a single product that

Q235: All other things the same, if a

Q357: A cost that would be included in

Q373: Hara Corporation is a wholesaler that sells

Q390: Allocating common fixed costs to segments on