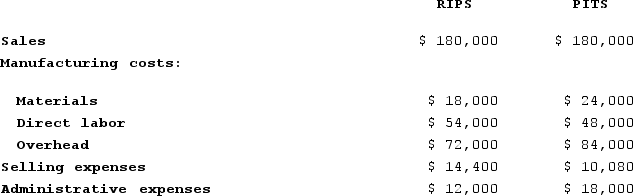

Omstadt Corporation produces and sells only two products that are referred to as RIPS and PITS. Production is "for order" only, and no finished goods inventories are maintained; work in process inventories are negligible. The following data relate to last month's operations:

$36,000 of the manufacturing overhead assigned to RIPS and $72,000 of that assigned to PITS is fixed. The balance of the overhead is variable. Selling expenses consist entirely of commissions paid as a percentage of sales. Direct labor is completely variable. Administrative expenses are fixed and cannot be traced to the products but have been arbitrarily allocated to the products.

$36,000 of the manufacturing overhead assigned to RIPS and $72,000 of that assigned to PITS is fixed. The balance of the overhead is variable. Selling expenses consist entirely of commissions paid as a percentage of sales. Direct labor is completely variable. Administrative expenses are fixed and cannot be traced to the products but have been arbitrarily allocated to the products.

Required:

Prepare a segmented income statement, in total and for the two products. Use the contribution approach.

Definitions:

Portal Triads

are structures in the liver consisting of a bile duct, a branch of the hepatic artery, and a branch of the hepatic portal vein.

Submucosa

The layer of dense irregular connective tissue or loose connective tissue that lies beneath a mucosa, providing it with nutrients and support.

Alimentary Canal

The whole passage along which food passes through the body from mouth to anus, including the esophagus, stomach, and intestines.

Common Hepatic Duct

A duct in the liver that carries bile from the liver and joins with the cystic duct to form the bile duct.

Q46: Data concerning three of Kilmon Corporation's activity

Q63: The Dorset Corporation produces and sells a

Q100: Alpha Corporation reported the following data for

Q150: Data concerning three of Kilmon Corporation's activity

Q155: Aresco Corporation manufactures two products: Product G51B

Q183: Bois Corporation has provided its contribution format

Q259: The units in beginning work in process

Q267: Boudoin Corporation manufactures two products: Product T72T

Q288: Murphy Incorporated, which produces a single product,

Q362: McCoy Corporation manufactures a computer monitor. Shown