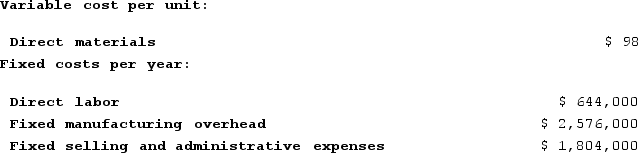

Woodall Corporation manufactures and sells one product. The following information pertains to the company's first year of operations:

The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 46,000 units and sold 44,000 units. The company's only product is sold for $235 per unit.Required:

The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 46,000 units and sold 44,000 units. The company's only product is sold for $235 per unit.Required:

a. Assume the company uses super-variable costing. Compute the unit product cost for the year and prepare an income statement for the year.b. Assume that the company uses a variable costing system that assigns $14 of direct labor cost to each unit that is produced. Compute the unit product cost for the year and prepare an income statement for the year.c. Assume that the company uses an absorption costing system that assigns $14 of direct labor cost and $56 of fixed manufacturing overhead to each unit that is produced. Compute the unit product cost for the year and prepare an income statement for the year.d. Prepare a reconciliation that explains the difference between the super-variable costing and variable costing net incomes.

e. Prepare a reconciliation that explains the difference between the super-variable costing and absorption costing net incomes.

Definitions:

Gainsharing Plan

A performance-related pay strategy designed to involve employees in improving productivity through sharing the resultant financial gains.

Profit Sharing Plan

A benefit plan where employees receive a portion of the company's profits, typically in the form of annual bonuses, aligning their interests with the financial success of the organization.

Piece Rate

A pay plan in which workers are paid a fixed sum for each unit of production completed.

Individual-Level

Pertaining to or focusing on actions, reactions, or impacts on a single person, as opposed to groups or organizations.

Q13: Miller Corporation produces a single product. The

Q25: Remmel Corporation has provided the following contribution

Q95: Schlaefer Corporation is conducting a time-driven activity-based

Q96: Neelon Corporation has two divisions: Southern Division

Q122: Uchimura Corporation has two divisions: the AFE

Q144: Lacourse Incorporated's inspection costs are listed below:

Q161: Decaprio Incorporated produces and sells a single

Q343: Orick Enterprises makes a variety of products

Q359: A shift in the sales mix from

Q396: Lister Corporation has provided the following contribution