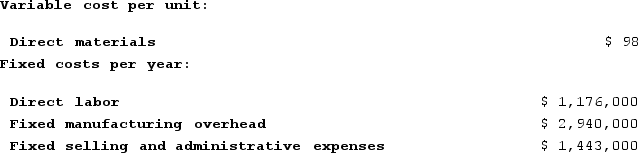

Shelko Corporation manufactures and sells one product. The following information pertains to the company's first year of operations:

The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 42,000 units and sold 37,000 units. The company's only product is sold for $272 per unit.Required:

The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 42,000 units and sold 37,000 units. The company's only product is sold for $272 per unit.Required:

a. Assume the company uses super-variable costing. Compute the unit product cost for the year and prepare an income statement for the year.b. Assume that the company uses an absorption costing system that assigns $28 of direct labor cost and $70 of fixed manufacturing overhead to each unit that is produced. Compute the unit product cost for the year and prepare an income statement for the year.c. Prepare a reconciliation that explains the difference between the super-variable costing and absorption costing net incomes.

Definitions:

Regulate Distress

The process of managing and mitigating emotional or psychological stress through various techniques or interventions.

Adaptive Approach

A method or strategy that emphasizes flexibility and the ability to change or adjust in response to the environment, challenges, or circumstances.

Adaptive Challenges

Complex problems that require new learning, innovation, and changes in people's values, beliefs, and behaviors.

Unclear Difficulties

Issues or circumstances that are vague, not easily understood, or defined, making resolution or management challenging.

Q16: Hayworth Corporation has just segmented last year's

Q20: Gardella Corporation has two divisions: Domestic Division

Q28: Keomuangtai Corporation produces and sells a single

Q65: Helmers Corporation manufactures a single product. Variable

Q109: Evan's Electronics Boutique sells a digital camera.

Q117: Electrical costs at one of Finfrock Corporation's

Q121: Callander Corporation is a wholesaler that sells

Q151: Least-squares regression selects the values for the

Q259: Haslem Incorporated has provided the following data

Q359: A shift in the sales mix from