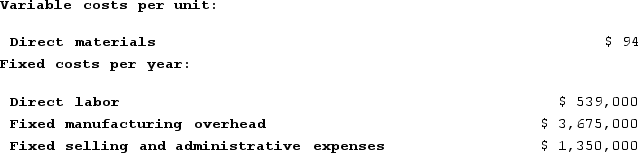

Tremble Corporation manufactures and sells one product. The following information pertains to the company's first year of operations:  The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 49,000 units and sold 45,000 units. The company's only product is sold for $233 per unit.The net operating income for the year under super-variable costing is:

The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 49,000 units and sold 45,000 units. The company's only product is sold for $233 per unit.The net operating income for the year under super-variable costing is:

Definitions:

Average Method

An inventory costing method that prices items based on the average cost of all similar items in inventory.

Cost of Goods Sold

The direct costs tied to the production of products sold by a company, including material and labor expenses.

Average Costs

The cost per unit calculated by dividing the total costs of production by the number of units produced.

Perpetual FIFO

An inventory management method where goods are sold in the order they are acquired, continuously updated to reflect sales and purchases.

Q82: Mcnamee Corporation's activity-based costing system has three

Q87: Greife Corporation's activity-based costing system has three

Q125: Lindenmuth Corporation is conducting a time-driven activity-based

Q128: A reason why absorption costing income statements

Q131: Lofft Corporation has provided the following contribution

Q181: Jorgenson Corporation has provided the following data

Q194: Tremble Corporation manufactures and sells one product.

Q201: Data concerning Follick Corporation's single product appear

Q243: Laraia Corporation has provided the following contribution

Q318: Davison Corporation, which has only one product,