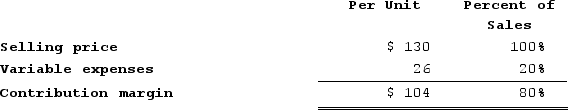

Data concerning Wislocki Corporation's single product appear below:

Fixed expenses are $466,000 per month. The company is currently selling 6,000 units per month.Required:The marketing manager would like to introduce sales commissions as an incentive for the sales staff. The marketing manager has proposed a commission of $11 per unit. In exchange, the sales staff would accept an overall decrease in their salaries of $55,000 per month. The marketing manager predicts that introducing this sales incentive would increase monthly sales by 100 units. What should be the overall effect on the company's monthly net operating income of this change?

Fixed expenses are $466,000 per month. The company is currently selling 6,000 units per month.Required:The marketing manager would like to introduce sales commissions as an incentive for the sales staff. The marketing manager has proposed a commission of $11 per unit. In exchange, the sales staff would accept an overall decrease in their salaries of $55,000 per month. The marketing manager predicts that introducing this sales incentive would increase monthly sales by 100 units. What should be the overall effect on the company's monthly net operating income of this change?

Definitions:

Salaries Payable

An account that records owed but unpaid wages to employees, regarded as a current liability on the balance sheet.

Prepaid Salaries

Expenses paid in advance for salaries, which are recorded as an asset on the balance sheet until they are actually incurred.

Salaries

Regular payments made to employees for performing their jobs, typically expressed as an annual amount but paid in smaller increments such as monthly or bi-weekly.

Expense Incurred

A cost that has been realized during the performance of business activities, pending payment or already paid.

Q17: Cadot Incorporated uses the weighted-average method in

Q44: Shelhorse Corporation produces and sells a single

Q58: Highjinks, Incorporated, has provided the following budgeted

Q98: Which of the following would not affect

Q155: Muckenfuss Clinic uses the step-down method to

Q200: Corbett Corporation manufactures a single product. Last

Q250: In a job-order costing system, indirect labor

Q254: Labadie Corporation manufactures and sells one product.

Q349: Arona Corporation manufactures canoes in two departments,

Q356: Easy Incorporated uses the first-in, first-out method