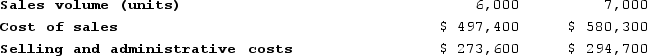

Callander Corporation is a wholesaler that sells a single product. Management has provided the following cost data for two levels of monthly sales volume. The company sells the product for $140.50 per unit.  The best estimate of the total contribution margin when 6,300 units are sold is: (Round your intermediate calculations to 2 decimal places.)

The best estimate of the total contribution margin when 6,300 units are sold is: (Round your intermediate calculations to 2 decimal places.)

Definitions:

Variable Manufacturing Costs

Charges that fluctuate based on the volume of production, like components used in product assembly and wages for workers on the production line.

Variable Selling Expenses

Selling costs that fluctuate with sales volume, such as commissions for sales staff.

Break-Even Sales

The amount of revenue required to cover all fixed and variable expenses, resulting in zero profit.

Variable Expenses

Expenses that vary directly with the level of production or sales, such as raw materials and direct labor costs.

Q45: Jerrel Corporation sells a product for $230

Q116: Malmedy Corporation uses the first-in, first-out method

Q165: Your boss would like you to estimate

Q196: Davitt Corporation produces a single product and

Q209: Nussbaum Corporation has provided the following contribution

Q232: In July, one of the processing departments

Q291: Huitron Incorporated expects its sales in September

Q337: Nantor Corporation has two divisions, Southern and

Q347: Crone Corporation uses the first-in, first-out method

Q364: Lucas Corporation uses the weighted-average method in