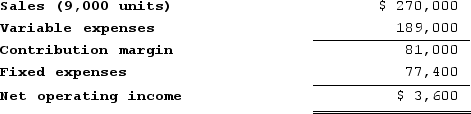

Stonebraker Corporation has provided the following contribution format income statement. All questions concern situations that are within the relevant range.

Required:

a. If sales increase to 9,040 units, what would be the estimated increase in net operating income?

b. If the variable cost per unit increases by $6, spending on advertising increases by $3,000, and unit sales increase by 19,200 units, what would be the estimated net operating income?

c. Estimate how many units must be sold to achieve a target profit of $26,100.

Definitions:

Restrictive Endorsement

A condition placed on a check or other financial document limiting its use or payment to a specific purpose or individual.

Redeemed

In healthcare or wellness, it often refers to the restoration or improvement of someone's health or condition.

Revenue Available

The total amount of income generated from sales or services before any expenses are deducted.

Expenses

Outflows or other using-up of assets or incurrences of liabilities during a period from delivering or producing goods, rendering services, or carrying out other activities that constitute the entity's ongoing major operations.

Q28: Keomuangtai Corporation produces and sells a single

Q47: Gamach Corporation is a wholesaler that sells

Q58: Carrington Corporation produces canned vegetable soup. The

Q94: For a given level of sales, a

Q104: On a Cost-Volume-Profit graph for a profitable

Q146: Krepps Corporation produces a single product. Last

Q180: Gayne Corporation's contribution margin ratio is 12%

Q257: Haffner Corporation uses the weighted-average method in

Q354: Sumter Corporation uses the weighted-average method in

Q371: Junior Bodway, Incorporated, has provided the following