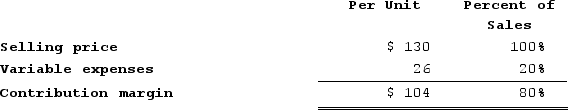

Data concerning Wislocki Corporation's single product appear below:

Fixed expenses are $466,000 per month. The company is currently selling 6,000 units per month.Required:The marketing manager would like to introduce sales commissions as an incentive for the sales staff. The marketing manager has proposed a commission of $11 per unit. In exchange, the sales staff would accept an overall decrease in their salaries of $55,000 per month. The marketing manager predicts that introducing this sales incentive would increase monthly sales by 100 units. What should be the overall effect on the company's monthly net operating income of this change?

Fixed expenses are $466,000 per month. The company is currently selling 6,000 units per month.Required:The marketing manager would like to introduce sales commissions as an incentive for the sales staff. The marketing manager has proposed a commission of $11 per unit. In exchange, the sales staff would accept an overall decrease in their salaries of $55,000 per month. The marketing manager predicts that introducing this sales incentive would increase monthly sales by 100 units. What should be the overall effect on the company's monthly net operating income of this change?

Definitions:

Perpetual Inventory System

A strategy for managing inventory accounting that utilizes computerized point-of-sale systems and enterprise asset management software to immediately document sales or purchases.

Accounts Payable

Obligations a business has to its creditors, arising from the purchase of goods and services on credit.

Perpetual Inventory System

A system for accounting inventory that instantly captures the transactions of buying or selling via computerized point-of-sale systems and software for enterprise asset management.

Gross Method

An accounting practice where purchases are recorded at their full invoice price without deducting discounts that may later be received.

Q12: Quates Corporation produces a single product and

Q32: Ensley Corporation has provided the following data

Q98: Activities in the Sargent Corporation's Assembly Department

Q109: Activity in Saggers Corporation's Assembly Department for

Q173: In August, one of the processing departments

Q215: A manufacturer of cedar shingles has supplied

Q256: Hougham Corporation uses a job-order costing system

Q258: A cement manufacturer has supplied the following

Q345: Last year, Rasband Corporation's variable costing net

Q382: An increase in the number of units