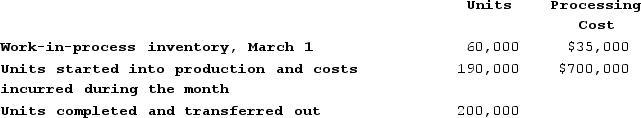

Owens Corporation uses a process costing system. For March, the beginning work in process inventory consisted of 60,000 units that were 60% complete with respect to processing. The ending work in process inventory for the month consisted of units that were 20% complete with respect to processing. A summary of unit and cost data for the month follows:  Assuming that Owens Corporation uses the first-in, first-out method, which of the following is closest to the cost per equivalent unit for processing cost for March?

Assuming that Owens Corporation uses the first-in, first-out method, which of the following is closest to the cost per equivalent unit for processing cost for March?

Definitions:

Personal Income Tax

A tax levied on individuals' earnings, including wages, salaries, and investment income, often progressive in nature.

Federal Expenditures

The spending by the federal government, including spending on defense, education, public welfare, and infrastructure projects.

National Debt

is the total amount of money that a country's government has borrowed, by various means, and has not yet repaid.

Top Marginal Tax Rate

The highest tax rate applied to the last dollar of taxable income, affecting the highest income earners within a progressive tax system.

Q42: Seifer Incorporated's inspection costs are listed below:

Q92: Borchardt Corporation has provided the following data

Q112: A company makes a single product that

Q121: Crich Corporation uses direct labor-hours in its

Q121: Intask Corporation uses the first-in, first-out method

Q135: Weyant Corporation has provided the following data

Q145: Lenning Corporation uses the first-in, first-out method

Q169: The following accounts are from last year's

Q227: Anchor Corporation has two service departments, Personnel

Q273: Angeloni Corporation uses a job-order costing system