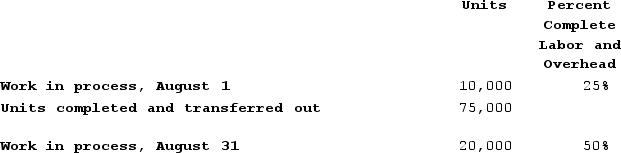

The information below was obtained from the records of one of the departments of Cushing Corporation for the month of August. The company uses the first-in, first-out method in its process costing system.  All materials are added at the beginning of the process.The equivalent units for materials for the month of August are:

All materials are added at the beginning of the process.The equivalent units for materials for the month of August are:

Definitions:

Average Tax Rate

The fraction of total income that is paid in taxes, calculated by dividing the total amount of taxes paid by the taxpayer's total income.

Legal Obligation

A requirement by law for an individual or entity to follow certain conduct or make certain payments.

Balance Budget

A financial plan or policy where total revenues are equal to or greater than total expenditures.

Tax Receipts

The total amount of money received by the government from taxes, serving as a primary source of revenue.

Q1: When manufacturing overhead is applied to production,

Q7: Sarratt Corporation's contribution margin ratio is 73%

Q8: Held Incorporated has provided the following data

Q17: Cadot Incorporated uses the weighted-average method in

Q136: Haffner Corporation uses the weighted-average method in

Q194: Jaquish Incorporated has provided the following data

Q259: The units in beginning work in process

Q286: Under the first-in, first-out method, in addition

Q293: Laurant Corporation uses the first-in, first-out method

Q325: An employee time ticket is used to