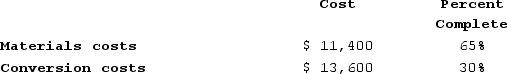

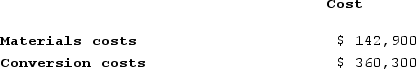

Gunes Corporation uses the weighted-average method in its process costing system. This month, the beginning inventory in the first processing department consisted of 1,600 units. The costs and percentage completion of these units in beginning inventory were:  A total of 9,300 units were started and 8,200 units were transferred to the second processing department during the month. The following costs were incurred in the first processing department during the month:

A total of 9,300 units were started and 8,200 units were transferred to the second processing department during the month. The following costs were incurred in the first processing department during the month: The ending inventory was 50% complete with respect to materials and 35% complete with respect to conversion costs.The cost per equivalent unit for materials for the month in the first processing department is closest to:

The ending inventory was 50% complete with respect to materials and 35% complete with respect to conversion costs.The cost per equivalent unit for materials for the month in the first processing department is closest to:

Definitions:

Absorption Costing

An accounting technique that assigns the total manufacturing costs, including direct materials, direct labor, and both kinds of manufacturing overhead (fixed and variable), to a product’s cost.

Gross Margin

The difference between sales revenue and cost of goods sold, expressed as a percentage of sales revenue, indicating the financial health and profitability of a business.

Absorption Costing

An approach to costing that encompasses all costs associated with manufacturing, including direct materials, direct labor, as well as variable and fixed manufacturing overheads, in the product cost.

Absorption Costing

A strategy in accounting practice that aggregates all manufacturing expenses, from direct materials and labor to variable and fixed overheads, into the determination of a product's cost.

Q17: Cadot Incorporated uses the weighted-average method in

Q75: Kolinski Surgical Hospital uses the direct method

Q116: Malmedy Corporation uses the first-in, first-out method

Q173: In August, one of the processing departments

Q199: A tile manufacturer has supplied the following

Q200: The step-down method of service department cost

Q219: The equivalent units of production for a

Q232: Zanetti Corporation produces and sells a single

Q262: The following information relates to the Cutting

Q292: Activity in Saggers Corporation's Assembly Department for