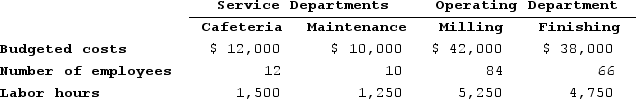

The James Corporation has four departments with data as follows:  Cafeteria costs are allocated on the basis of number of employees. If the step-down method is used with costs of the Cafeteria allocated first, the amount of cost allocated from the Cafeteria to Maintenance would be:

Cafeteria costs are allocated on the basis of number of employees. If the step-down method is used with costs of the Cafeteria allocated first, the amount of cost allocated from the Cafeteria to Maintenance would be:

Definitions:

Digital Audio

Sound that has been recorded, stored, or transmitted in a digital format, allowing for manipulation and distribution without degradation of quality.

Video File

A digital file format used to store video data on a computer or media storage device.

Downloaded

The process of receiving data from the internet or another remote system to your computer or device.

Internal Corporate Communication Platform

A digital tool or system used within a company to facilitate communication and information sharing among employees.

Q13: Domingo Corporation uses the weighted-average method in

Q24: Gilchrist Corporation bases its predetermined overhead rate

Q41: Data concerning Cavaluzzi Corporation's single product appear

Q73: Venzke Corporation uses a job-order costing system

Q86: Stangl Incorporated has provided the following data

Q112: Parker Corporation has two service departments, Cafeteria

Q164: Sumter Corporation uses the weighted-average method in

Q226: Overapplied manufacturing overhead would result if:<br>A) the

Q239: Atteberry Corporation has two manufacturing departments--Machining and

Q267: Advertising costs should NOT be charged to