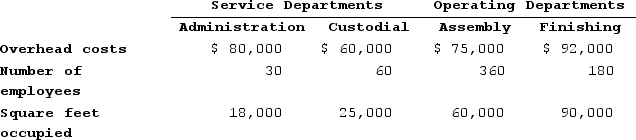

The Thomas Corporation has two service departments and two operating departments. The following data are available for a recent period:  Thomas allocates service department costs by the step-down method in the following order: Administrative Department costs are allocated first, based on number of employees; Custodial Department costs are allocated second, based on square feet occupied. No distinction is made between fixed and variable costs.After the allocations, the total amount of overhead cost contained in the Finishing Department will be:

Thomas allocates service department costs by the step-down method in the following order: Administrative Department costs are allocated first, based on number of employees; Custodial Department costs are allocated second, based on square feet occupied. No distinction is made between fixed and variable costs.After the allocations, the total amount of overhead cost contained in the Finishing Department will be:

Definitions:

Effective Interest Method

A method of calculating the amortized cost of a financial asset or liability and allocating the interest income or expense over the relevant period.

Interest Rate

The percentage charged on a loan or paid on deposits over a specific period, usually expressed as an annual percentage of the principal.

Amortization Assumption

The accounting practice of gradually writing off the initial cost of an intangible asset over its useful life.

Interest Expense

The cost incurred by an entity for borrowed funds; interest payments made on any form of debt over a given period.

Q54: A manufacturer of tiling grout has supplied

Q78: Mundes Corporation uses the weighted-average method in

Q129: In a job-order costing system, which of

Q187: Able Corporation uses a job-order costing system.

Q222: Vogel Corporation's cost of goods manufactured last

Q250: In February, one of the processing departments

Q269: Refer to the T-account below: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8314/.jpg"

Q327: Strzelecki Corporation uses the step-down method to

Q352: Gunes Corporation uses the weighted-average method in

Q372: Below are cost and activity data for