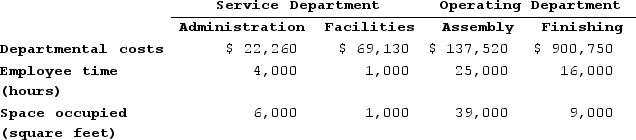

Coakley Corporation uses the step-down method to allocate service department costs to operating departments. The company has two service departments, Administration and Facilities, and two operating departments, Assembly and Finishing.

Administration Department costs are allocated first on the basis of employee time and Facilities Department costs are allocated second on the basis of space occupied. Required: Allocate the service department costs to the operating departments using the step-down method.

Administration Department costs are allocated first on the basis of employee time and Facilities Department costs are allocated second on the basis of space occupied. Required: Allocate the service department costs to the operating departments using the step-down method.

Definitions:

Straight-Line Depreciation

A method of allocating the cost of a tangible asset over its useful life in equal annual amounts, making the expense predictable and consistent.

Income Taxes

Taxes levied by governments on individuals' or businesses' net income, where the amount owed varies based on the level of the income earned.

Operating Cash Inflow

Cash generated from a company's primary business operations, excluding non-operational sources like investments or financing.

Capital Budgeting

The process of evaluating and selecting long-term investments that are in line with the goal of maximizing a firm's value through strategic asset allocation.

Q145: Tyare Corporation had the following inventory balances

Q188: Giannitti Corporation bases its predetermined overhead rate

Q227: Anchor Corporation has two service departments, Personnel

Q244: Dearden Corporation uses a job-order costing system

Q253: Stockmaster Corporation has two manufacturing departments--Forming and

Q280: From the standpoint of cost control, the

Q285: Acheson Corporation, which applies manufacturing overhead on

Q328: When computing the cost per equivalent unit,

Q329: Paceheco Corporation uses the weighted-average method in

Q351: Ockey Corporation uses the direct method to