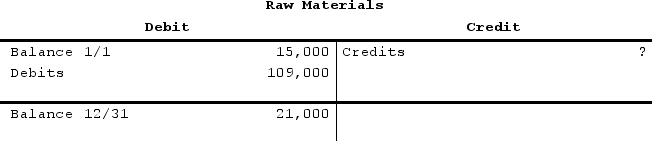

Hougham Corporation uses a job-order costing system and has provided the following partially completed T-account summary for the past year.  The cost of raw materials requisitioned for use in production during the year was:

The cost of raw materials requisitioned for use in production during the year was:

Definitions:

Corporation

A legal entity that is distinct from its owners, offering limited liability and the ability to raise capital by selling shares.

Sole Proprietorship

A type of enterprise owned and operated by one person, where there is no legal distinction between the owner and the business operation.

Double Taxation

The imposition of two or more taxes on the same income, asset, or financial transaction.

Not-for-Profit Organization

An organization that operates for purposes other than making a profit, often focusing on social, educational, or charitable objectives.

Q95: Steele Corporation uses a predetermined overhead rate

Q105: In October, Raddatz Incorporated incurred $73,000 of

Q171: Kapanga Manufacturing Corporation uses a job-order costing

Q210: The management of Dethlefsen Corporation would like

Q216: The journal entry to record applying overhead

Q291: On January 1, Schaf Corporation had $23,000

Q294: Firebaugh Corporation is a manufacturer that uses

Q296: Feuerborn Corporation uses a job-order costing system

Q356: Opunui Corporation has two manufacturing departments--Molding and

Q357: Activities in the Sargent Corporation's Assembly Department