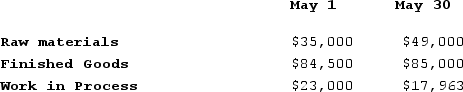

Tyare Corporation had the following inventory balances at the beginning and end of May:  During May, $68,000 in raw materials (all direct materials) were drawn from inventory and used in production. The company's predetermined overhead rate was $12 per direct labor-hour, and it paid its direct labor workers $15 per hour. A total of 490 hours of direct labor time had been expended on the jobs in the beginning Work in Process inventory account. The ending Work in Process inventory account contained $8,000 of direct materials cost. The Corporation incurred $44,850 of actual manufacturing overhead cost during the month and applied $45,300 in manufacturing overhead cost.The raw materials purchased during May totaled:

During May, $68,000 in raw materials (all direct materials) were drawn from inventory and used in production. The company's predetermined overhead rate was $12 per direct labor-hour, and it paid its direct labor workers $15 per hour. A total of 490 hours of direct labor time had been expended on the jobs in the beginning Work in Process inventory account. The ending Work in Process inventory account contained $8,000 of direct materials cost. The Corporation incurred $44,850 of actual manufacturing overhead cost during the month and applied $45,300 in manufacturing overhead cost.The raw materials purchased during May totaled:

Definitions:

Production Department

The segment of a manufacturing firm dedicated to producing finished goods from raw materials or components.

Support Department

Units within an organization that provide essential services or support to the production departments but are not directly involved in the primary business operations.

Diesel Engine

An internal combustion engine in which air is compressed to a high degree to ignite diesel fuel injected into the cylinder, used in most heavy-duty vehicles.

Activity-Based Costing

A methodology in accounting that assigns costs to products or services based on the activities and resources that are consumed in the process of providing them.

Q30: Casas Corporation has two service departments, Personnel

Q44: Tevebaugh Corporation is a manufacturer that uses

Q130: Holmstrom Corporation has provided the following data

Q165: Hickingbottom Corporation has two production departments, Forming

Q209: Fuller Corporation uses the weighted-average method in

Q223: Sivret Corporation uses a job-order costing system

Q225: When the predetermined overhead rate is based

Q243: Nielsen Corporation has two manufacturing departments--Machining and

Q311: Beat Corporation uses a job-order costing system

Q352: Actual overhead costs are not assigned to