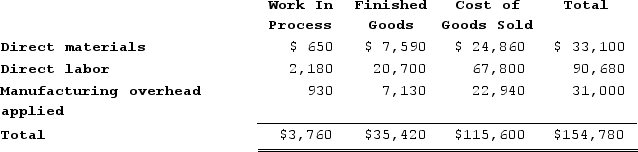

Centore Incorporated has provided the following data for the month of June. There were no beginning inventories; consequently, the direct materials, direct labor, and manufacturing overhead applied listed below are all for the current month.  Manufacturing overhead for the month was underapplied by $3,000.The company allocates any underapplied or overapplied manufacturing overhead among work in process, finished goods, and cost of goods sold at the end of the month on the basis of the overhead applied during the month in those accounts.The work in process inventory at the end of June after allocation of any underapplied or overapplied manufacturing overhead for the month is closest to:

Manufacturing overhead for the month was underapplied by $3,000.The company allocates any underapplied or overapplied manufacturing overhead among work in process, finished goods, and cost of goods sold at the end of the month on the basis of the overhead applied during the month in those accounts.The work in process inventory at the end of June after allocation of any underapplied or overapplied manufacturing overhead for the month is closest to:

Definitions:

Stock Exchanges

Marketplaces where securities, such as stocks and bonds, are bought and sold.

Pure Interest Rate

The theoretical rate of return of an investment with no risk of financial loss, not influenced by demand for investments or market risks.

Earning Power

A company's ability to generate profit from its operations over time and maintain financial stability.

Inflation

The velocity at which the overall cost of products and services climbs, reducing purchasing capability.

Q21: Caple Corporation applies manufacturing overhead on the

Q23: The information below was obtained from the

Q154: Look Manufacturing Corporation has a traditional costing

Q160: Morataya Corporation has two manufacturing departments--Machining and

Q213: Montuori Corporation uses a job-order costing system

Q264: Brothern Corporation bases its predetermined overhead rate

Q269: Stoltz Corporation uses the direct method to

Q293: The following partially completed T-accounts summarize transactions

Q298: Puri Corporation uses the first-in, first-out method

Q360: The weighted-average method of process costing differs