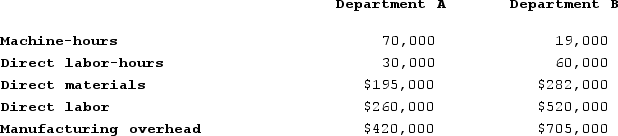

Dotsero Technology, Inc., has a job-order costing system. The company uses predetermined overhead rates in applying manufacturing overhead cost to individual jobs. The predetermined overhead rate in Department A is based on machine-hours, and the rate in Department B is based on direct materials cost. At the beginning of the most recent year, the company's management made the following estimates for the year:

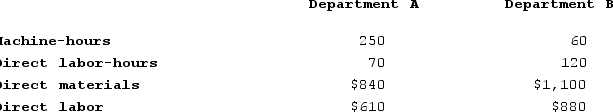

Job 243 entered into production an April 1 and was completed on May 12. The company's cost records show the following information about the job:

Job 243 entered into production an April 1 and was completed on May 12. The company's cost records show the following information about the job:

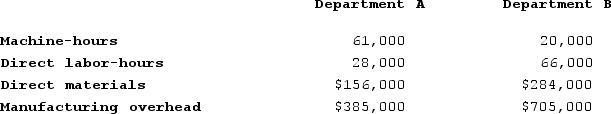

At the end of the year, the records of Dotsero showed the following actual cost and operating data for all jobs worked on during the year:

At the end of the year, the records of Dotsero showed the following actual cost and operating data for all jobs worked on during the year:

Required:

Required:

a. Compute the predetermined overhead rates for Department A and Department B.

b. Compute the total overhead cost applied to Job 243.

c. Compute the amount of underapplied or overapplied overhead in each department at the end of the current year.

Definitions:

Normal Balance

The usual debit or credit balance that an account type is expected to have, which helps in ensuring the correct recording of transactions.

Debit

An accounting entry that results in either an increase in assets or a decrease in liabilities on a company's balance sheet.

Dividends Declared

Profits distributed by a company to its shareholders, usually determined by the board of directors, and not yet paid out.

Normal Balance

The side (debit or credit) of an account that is typically increased; for assets and expenses, it's a debit; for liabilities, equity, and revenue, it's a credit.

Q22: Yamane Corporation, a manufacturer, uses the step-down

Q39: On November 1, Arvelo Corporation had $39,500

Q60: Niles Corporation is a manufacturer that uses

Q67: The following data have been recorded for

Q84: Salmont Corporation uses the first-in, first-out method

Q114: Molzahn Corporation is a manufacturer that uses

Q139: Entry (1) in the below T-account represents

Q212: The management of Bullinger Corporation would like

Q266: Kalp Corporation has two production departments, Machining

Q309: Lupo Corporation uses a job-order costing system