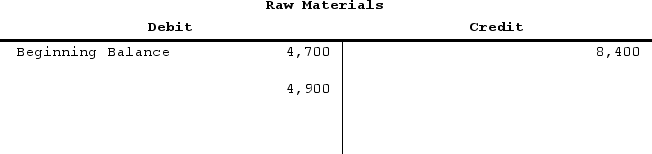

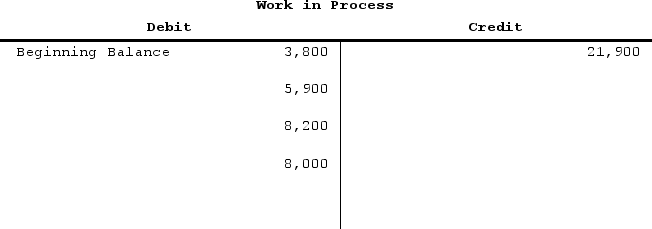

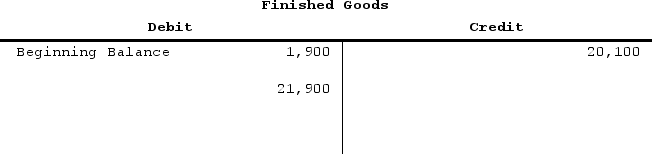

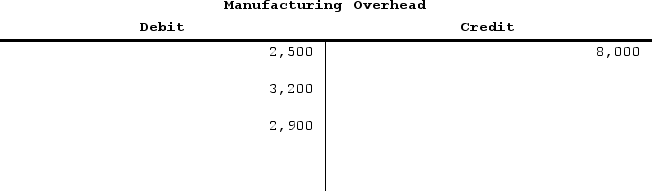

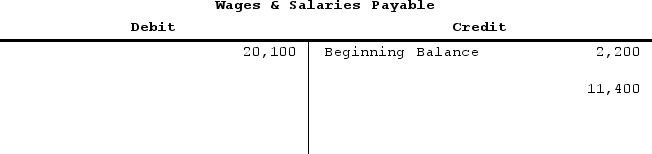

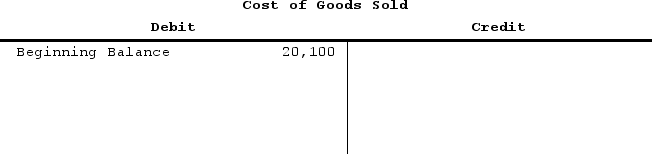

The following partially completed T-accounts summarize transactions for Faaberg Corporation during the year:

The direct materials cost was:

The direct materials cost was:

Definitions:

Process Cost Report

A financial report in managerial accounting that summarizes the costs associated with processes or production departments, tracking material, labor, and overhead.

Allocation Costs

The process of distributing indirect costs to different departments, products, or projects based on relevant cost drivers.

Production Report

A document detailing the quantity and type of products manufactured within a specific period, including details on efficiency and usage of resources.

First-In, First-Out Method

An inventory valuation method that assumes goods are sold in the order they are acquired, with the oldest items sold first.

Q16: Heroux Corporation has two manufacturing departments--Forming and

Q69: Dagostino Corporation uses a job-order costing system.The

Q93: Gonzalez, Inc. manufactures stereo speakers in two

Q140: Dukes Corporation used a predetermined overhead rate

Q149: Jurica Corporation has two production departments, Forming

Q155: Muckenfuss Clinic uses the step-down method to

Q176: Onyemah Corporation uses the first-in, first-out method

Q187: Able Corporation uses a job-order costing system.

Q228: Vercher Natal Clinic uses the step-down method

Q280: Lupo Corporation uses a job-order costing system