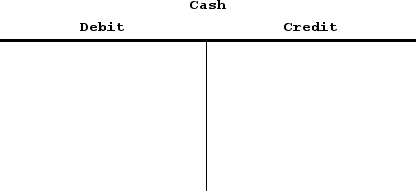

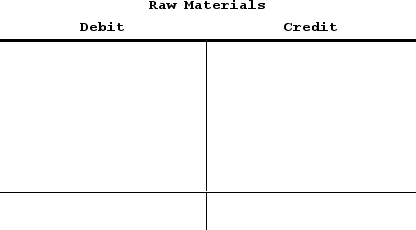

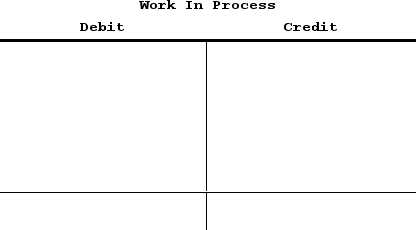

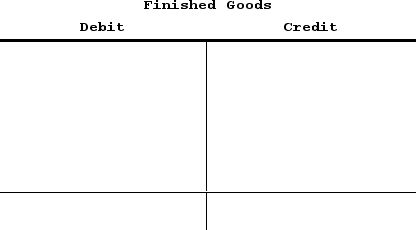

Leak Enterprises LLC recorded the following transactions for the just completed month. The company had no beginning inventories.(1) Raw materials purchased for cash, $96,000(2) Direct materials requisitioned for use in production, $69,000(3) Indirect materials requisitioned for use in production, $22,000(4) Direct labor wages incurred and paid, $129,000(5) Indirect labor wages incurred and paid, $16,000(6) Additional manufacturing overhead costs incurred and paid, $121,000(7) Manufacturing overhead costs applied to jobs, $163,000(8) All of the jobs in process were completed.(9) All of the completed jobs were shipped to customers.(10) Any underapplied or overapplied overhead for the period was closed out to Cost of Goods Sold.Use the following T-accounts to answer the following question.

The ending balance in the Raw Materials account is closest to:

The ending balance in the Raw Materials account is closest to:

Definitions:

Preferred Stock

A type of stock that provides dividends to its holders before common stocks and has priority over common stock in the event of a liquidation.

Tax Deductible

Expenses that can be subtracted from gross income to reduce the overall amount of income tax owed to the government.

Gordon Model

A financial model that evaluates a stock's intrinsic value, based on future series of dividends that grow at a constant rate.

Growth Rate Assumption

An estimated rate at which a variable, such as a company's revenue or the economy's GDP, is expected to grow.

Q63: Kapanga Manufacturing Corporation uses a job-order costing

Q88: Bierce Corporation has two manufacturing departments--Machining and

Q124: Luarca Corporation has two manufacturing departments--Casting and

Q128: Gallon Corporation had $24,000 of raw materials

Q223: Rediger Incorporated a manufacturing Corporation, has provided

Q226: Overapplied manufacturing overhead would result if:<br>A) the

Q235: Tomey Corporation has two production departments, Forming

Q237: Kalp Corporation has two production departments, Machining

Q282: Dorman Music Corporation manufactures guitars and uses

Q316: Tabet Corporation uses the first-in, first-out method