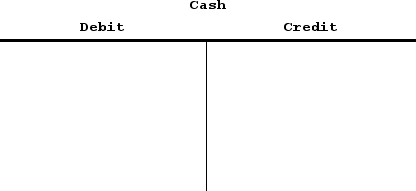

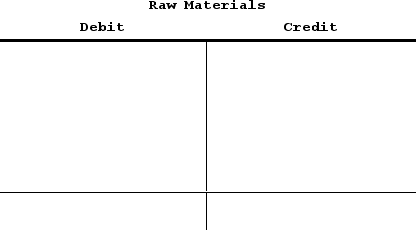

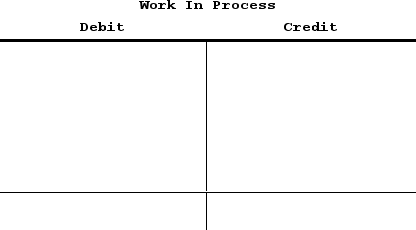

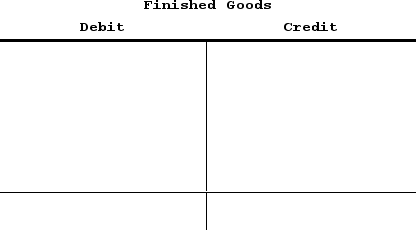

Leak Enterprises LLC recorded the following transactions for the just completed month. The company had no beginning inventories.(1) Raw materials purchased for cash, $96,000(2) Direct materials requisitioned for use in production, $69,000(3) Indirect materials requisitioned for use in production, $22,000(4) Direct labor wages incurred and paid, $129,000(5) Indirect labor wages incurred and paid, $16,000(6) Additional manufacturing overhead costs incurred and paid, $121,000(7) Manufacturing overhead costs applied to jobs, $163,000(8) All of the jobs in process were completed.(9) All of the completed jobs were shipped to customers.(10) Any underapplied or overapplied overhead for the period was closed out to Cost of Goods Sold.Use the following T-accounts to answer the following question.

The adjusted cost of goods sold for the month is:

The adjusted cost of goods sold for the month is:

Definitions:

Cost-Benefit Analysis

An economic evaluation method that compares the costs and benefits of a project or decision to determine its feasibility or compare alternatives.

Free-Rider Problem

A situation in economics where individuals consume more than their fair share of a public resource, or shoulder less of the cost of its provision, leading to underproduction or depletion of the resource.

Aristotle

An ancient Greek philosopher and scientist, one of the greatest intellectual figures of Western history.

Free Riders

Free riders are individuals who benefit from resources, goods, or services without paying for the cost of the benefit, often leading to inefficiencies in markets or public services.

Q36: Holling Incorporated uses the weighted-average method in

Q52: Assigning manufacturing overhead to a specific job

Q66: Opunui Corporation has two manufacturing departments--Molding and

Q176: Onyemah Corporation uses the first-in, first-out method

Q179: Koczela Incorporated has provided the following data

Q248: The management of Holdaway Corporation would like

Q285: Acheson Corporation, which applies manufacturing overhead on

Q290: Gerstein Corporation uses a job-order costing system

Q295: The following accounts are from last year's

Q312: Carver Corporation uses the first-in, first-out method