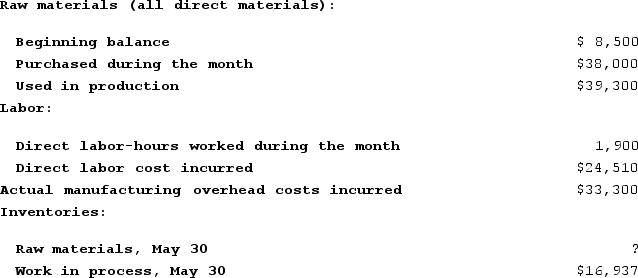

Dacosta Corporation had only one job in process on May 1. The job had been charged with $1,800 of direct materials, $6,966 of direct labor, and $9,936 of manufacturing overhead cost. The company assigns overhead cost to jobs using the predetermined overhead rate of $18.40 per direct labor-hour. During May, the following activity was recorded: Work in process inventory on May 30 contains $3,741 of direct labor cost. Raw materials consist solely of items that are classified as direct materials.The balance in the raw materials inventory account on May 30 was:

Work in process inventory on May 30 contains $3,741 of direct labor cost. Raw materials consist solely of items that are classified as direct materials.The balance in the raw materials inventory account on May 30 was:

Definitions:

Exposure-Draft Stage

A phase in the standard-setting process where a proposed accounting standard is made public for feedback before it becomes final.

Statutory Authority

The legal power granted to an entity, often a government agency, to enact legislation, regulate, or enforce laws.

Accounting Rules

The standardized guidelines and criteria used in financial accounting and reporting to ensure transparency, consistency, and comparability of financial statements.

Securities and Exchange Commission

A U.S. government agency responsible for regulating the securities markets and protecting investors.

Q20: Entry (11) in the below T-account could

Q31: Dehner Corporation uses a job-order costing system

Q70: Beans Corporation uses a job-order costing system

Q82: Moscone Corporation bases its predetermined overhead rate

Q103: Carpenter Corporation uses the weighted-average method in

Q153: Activities in the Challenger Corporation's Assembly Department

Q172: Rondo Corporation uses a job-order costing system

Q206: Watts Corporation has a Custodial Services Department

Q219: Tyare Corporation had the following inventory balances

Q222: Mccaughan Corporation bases its predetermined overhead rate