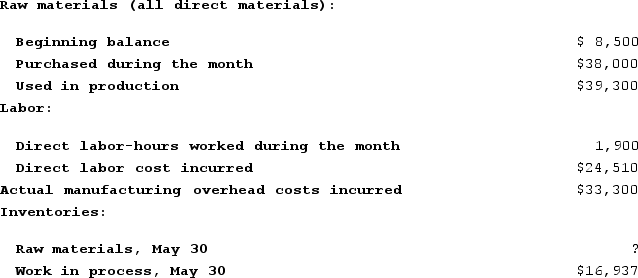

Dacosta Corporation had only one job in process on May 1. The job had been charged with $1,800 of direct materials, $6,966 of direct labor, and $9,936 of manufacturing overhead cost. The company assigns overhead cost to jobs using the predetermined overhead rate of $18.40 per direct labor-hour. During May, the following activity was recorded: Work in process inventory on May 30 contains $3,741 of direct labor cost. Raw materials consist solely of items that are classified as direct materials.The entry to dispose of the underapplied or overapplied manufacturing overhead cost for the month would include a:

Work in process inventory on May 30 contains $3,741 of direct labor cost. Raw materials consist solely of items that are classified as direct materials.The entry to dispose of the underapplied or overapplied manufacturing overhead cost for the month would include a:

Definitions:

Financing Activities

Transactions related to raising and repaying capital, such as issuing stocks or bonds and paying dividends.

Net Cash

The amount of cash that is available after all debts and expenses have been paid.

Investing Activities

Transactions involving the acquisition or sale of long-term assets and other investments not included in cash equivalents.

Statement Of Cash Flows

A financial statement that shows how changes in balance sheet accounts and income affect cash and cash equivalents.

Q81: Molash Corporation has two manufacturing departments--Machining and

Q141: DaostaIncorporated uses the first-in, first-out method in

Q230: Claybrooks Corporation has two manufacturing departments--Casting and

Q296: Feuerborn Corporation uses a job-order costing system

Q300: Lenning Corporation uses the first-in, first-out method

Q300: Njombe Corporation manufactures a variety of products.

Q308: During March, Zea Incorporated transferred $50,000 from

Q312: Carver Corporation uses the first-in, first-out method

Q353: The amount of overhead applied to a

Q364: Ahlheim Corporation has two production departments, Forming