The Collins Corporation uses a job-order costing system and applies manufacturing overhead cost to jobs on the basis of the cost of materials used in production. At the beginning of the most recent year, the following estimates were made as a basis for computing the predetermined overhead rate for the year: manufacturing overhead cost, $200,000; direct materials cost, $160,000. The following transactions took place during the year (all purchases and services were acquired on account):

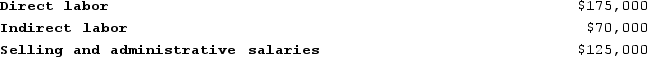

Raw materials were purchased, $86,000.Raw materials were requisitioned for use in production (all direct materials), $98,000.Utility costs were incurred in the factory, $15,000.Salaries and wages were incurred as follows:

Definitions:

Net Income

The total profit of a company after all expenses, including taxes and operating expenses, have been deducted from total revenues.

Common Shares

Equity investments that represent a portion of ownership in a corporation, giving shareholders voting rights and potential dividends.

Stockholders' Equity

The ownership interest of shareholders in the assets of a corporation after all debts have been paid.

Retained Earnings

Retained earnings are the portion of a company's profits that are kept or reinvested in the business instead of being distributed to shareholders as dividends.

Q6: On November 1, Arvelo Corporation had $32,000

Q18: The management of Featheringham Corporation would like

Q35: Chavez Corporation reported the following data for

Q49: Harootunian Corporation uses a job-order costing system

Q67: Details of the manufacturing activity in Amy

Q130: Holmstrom Corporation has provided the following data

Q140: The three cost elements ordinarily included in

Q253: Echher Corporation uses a job-order costing system

Q262: Sivret Corporation uses a job-order costing system

Q352: Actual overhead costs are not assigned to