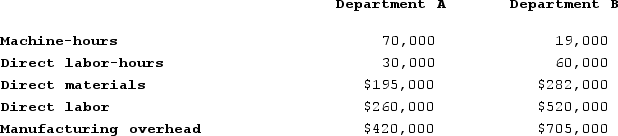

Dotsero Technology, Inc., has a job-order costing system. The company uses predetermined overhead rates in applying manufacturing overhead cost to individual jobs. The predetermined overhead rate in Department A is based on machine-hours, and the rate in Department B is based on direct materials cost. At the beginning of the most recent year, the company's management made the following estimates for the year:

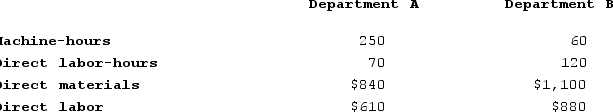

Job 243 entered into production an April 1 and was completed on May 12. The company's cost records show the following information about the job:

Job 243 entered into production an April 1 and was completed on May 12. The company's cost records show the following information about the job:

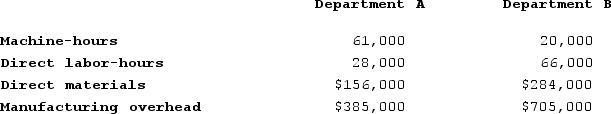

At the end of the year, the records of Dotsero showed the following actual cost and operating data for all jobs worked on during the year:

At the end of the year, the records of Dotsero showed the following actual cost and operating data for all jobs worked on during the year:

Required:

Required:

a. Compute the predetermined overhead rates for Department A and Department B.

b. Compute the total overhead cost applied to Job 243.

c. Compute the amount of underapplied or overapplied overhead in each department at the end of the current year.

Definitions:

Independently

Independently means acting on one's own without influence, support, or control from others, often implying self-sufficiency or autonomy.

Critical Thinking

The objective analysis and evaluation of an issue in order to form a judgment.

Passive Behavior

A pattern of avoiding direct communication, conflict, or confrontation, often characterized by compliance, avoidance of responsibility, and failing to express one’s own needs or preferences.

Vroom-Yetton-Jago

A decision-making model that helps leaders determine the appropriate level of employee participation in decision making based on situational variables.

Q97: Shane Corporation has provided the following data

Q147: Overly Corporation uses a job-order costing system

Q155: Muckenfuss Clinic uses the step-down method to

Q176: Onyemah Corporation uses the first-in, first-out method

Q192: Lupo Corporation uses a job-order costing system

Q233: Crich Corporation uses direct labor-hours in its

Q249: A number of companies in different industries

Q265: A fixed cost is constant if expressed

Q285: Acheson Corporation, which applies manufacturing overhead on

Q383: Prather Corporation uses a job-order costing system