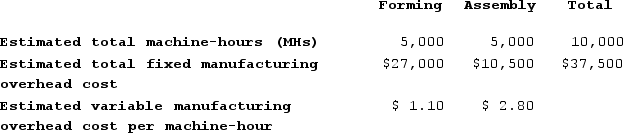

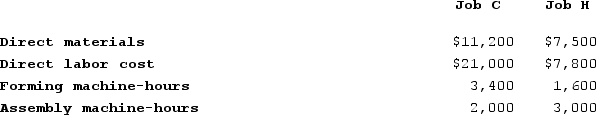

Stockmaster Corporation has two manufacturing departments--Forming and Assembly. The company used the following data at the beginning of the year to calculate predetermined overhead rates:  During the most recent month, the company started and completed two jobs--Job C and Job H. There were no beginning inventories. Data concerning those two jobs follow:

During the most recent month, the company started and completed two jobs--Job C and Job H. There were no beginning inventories. Data concerning those two jobs follow: Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours and uses a markup of 40% on manufacturing cost to establish selling prices. The calculated selling price for Job C is closest to: (Round your intermediate calculations to 2 decimal places.)

Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours and uses a markup of 40% on manufacturing cost to establish selling prices. The calculated selling price for Job C is closest to: (Round your intermediate calculations to 2 decimal places.)

Definitions:

Uncollectible Percentage

Estimate of the portion of accounts receivable that will not be collected, used in calculating bad debt expense.

Bad Debt Expense

An expense reported on the income statement, reflecting the cost of accounts receivable that a company does not expect to collect due to customers' inability to pay.

Aging of Accounts

A method used to categorize accounts receivable based on the length of time an invoice has been outstanding, often to identify potential collection issues.

Gross Price Method

An accounting method where inventory purchases are recorded at their gross price, without deducting any available cash discounts.

Q9: Temby Corporation uses a job-order costing system

Q11: If the actual manufacturing overhead cost for

Q44: Marciante Corporation has two production departments, Casting

Q92: In a job-order costing system, costs are

Q117: The following data have been provided by

Q171: The fixed portion of the cost of

Q206: Watts Corporation has a Custodial Services Department

Q242: Which of the following statements is correct

Q245: Seidell Corporation has two service departments, Administrative

Q334: Opunui Corporation has two manufacturing departments--Molding and