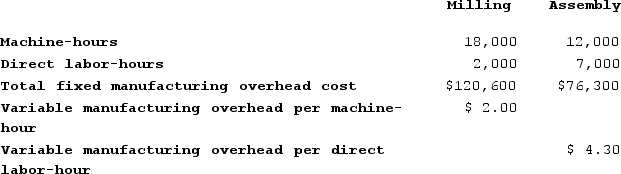

Boward Corporation has two production departments, Milling and Assembly. The company uses a job-order costing system and computes a predetermined overhead rate in each production department. The Milling Department's predetermined overhead rate is based on machine-hours and the Assembly Department's predetermined overhead rate is based on direct labor-hours. At the beginning of the current year, the company had made the following estimates:  During the current month the company started and finished Job T818. The following data were recorded for this job:

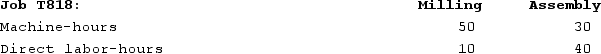

During the current month the company started and finished Job T818. The following data were recorded for this job: The total amount of overhead applied in both departments to Job T818 is closest to: (Round your intermediate calculations to 2 decimal places.)

The total amount of overhead applied in both departments to Job T818 is closest to: (Round your intermediate calculations to 2 decimal places.)

Definitions:

Total Cost

The complete cost of production, including both fixed and variable costs. It represents the entire expense incurred in producing a good or service.

Free Entry

A market condition where firms can enter the industry without any barriers to entry, promoting competition.

Exit

In economic terms, the process of withdrawing from a market, ceasing operations, or ending an investment.

Committed Cost

Expenses that a company has already made or obliged itself to make in the future, often fixed and not easily changed.

Q10: Lueckenhoff Corporation uses a job-order costing system

Q25: Eisentrout Corporation has two production departments, Machining

Q30: Decorte Corporation uses a job-order costing system

Q48: Bellucci Corporation has provided the following information:

Q53: In July, one of the processing departments

Q56: Chavez Corporation reported the following data for

Q59: Coudriet Manufacturing Corporation has a traditional costing

Q167: At an activity level of 7,200 machine-hours

Q252: Gilchrist Corporation bases its predetermined overhead rate

Q283: Entry (16) in the below T-account represents