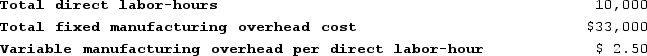

Decorte Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on direct labor-hours. The company based its predetermined overhead rate for the current year on the following data:  Recently, Job K332 was completed with the following characteristics:

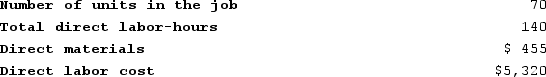

Recently, Job K332 was completed with the following characteristics: The unit product cost for Job K332 is closest to: (Round your intermediate calculations to 2 decimal places.)

The unit product cost for Job K332 is closest to: (Round your intermediate calculations to 2 decimal places.)

Definitions:

Equity Method

An accounting method used to assess the profits earned by investments in other companies, where the investment's value is adjusted according to the investor’s share of the investee's profit or loss.

Net Loss

The negative financial result when a company's total expenses exceed its total revenues during a specified accounting period.

Equity Method

An accounting technique used by companies to record their investments in other companies when they have significant influence but not full control.

Intra-entity Inventory

Intra-entity Inventory pertains to the goods sold between divisions or entities within the same parent company, affecting consolidated financial statements.

Q28: Dejarnette Corporation uses a job-order costing system

Q37: Prime cost equals manufacturing overhead cost.

Q61: Decorte Corporation uses a job-order costing system

Q156: The appeal of using multiple departmental overhead

Q245: Testor Products uses a job-order costing system

Q279: The following cost data relate to the

Q288: Mahon Corporation has two production departments, Casting

Q308: Dake Corporation's relevant range of activity is

Q339: Mccaskell Corporation's relevant range of activity is

Q356: Opunui Corporation has two manufacturing departments--Molding and