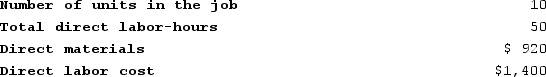

Beans Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on direct labor-hours. The company based its predetermined overhead rate for the current year on total fixed manufacturing overhead cost of $162,000, variable manufacturing overhead of $2.80 per direct labor-hour, and 60,000 direct labor-hours. Recently, Job K818 was completed with the following characteristics:  The unit product cost for Job K818 is closest to: (Round your intermediate calculations to 2 decimal places.)

The unit product cost for Job K818 is closest to: (Round your intermediate calculations to 2 decimal places.)

Definitions:

Gross Wages

The total amount of salary or wages earned by an employee before any deductions or taxes are applied.

Social Security

A governmental program providing financial assistance to people with inadequate or no income, especially the elderly, disabled, and families with dependent children.

Unemployment Taxes

This term refers to taxes imposed on employers based on the wages paid to employees, used to fund unemployment insurance programs.

Warranty Obligations

A company's legal responsibility to repair or replace defective products within a specified period.

Q43: Rotonga Manufacturing Company leases a vehicle to

Q81: Rhome Corporation's relevant range of activity is

Q107: Deloria Corporation has two production departments, Forming

Q126: Caple Corporation applies manufacturing overhead on the

Q149: In December, one of the processing departments

Q155: Levron Corporation uses a job-order costing system

Q209: Pasko Corporation uses a job-order costing system

Q314: Vignana Corporation manufactures and sells hand-painted clay

Q320: Contribution margin and gross margin mean the

Q344: The management of Featheringham Corporation would like