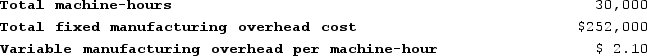

Lupo Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on machine-hours. The company based its predetermined overhead rate for the current year on the following data:  Recently, Job T687 was completed with the following characteristics:

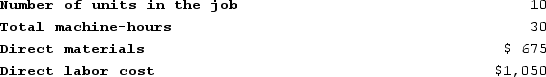

Recently, Job T687 was completed with the following characteristics: The predetermined overhead rate is closest to:

The predetermined overhead rate is closest to:

Definitions:

Job-Order Costing System

An accounting method that accumulates costs for individual units or small batches of production, often used for custom orders.

Direct Materials

Raw materials that are directly traceable to the production of a specific product.

Indirect Labor

Indirect labor involves workers who support the production process but do not directly work on the product, such as maintenance staff.

Direct Labor

The cost of wages for employees who directly manufacture or produce goods.

Q2: Conversion cost equals product cost less direct

Q67: The following data have been recorded for

Q106: Bottum Corporation, a manufacturing Corporation, has provided

Q136: Amunrud Corporation uses a job-order costing system

Q151: Beans Corporation uses a job-order costing system

Q225: The following accounts are from last year's

Q252: The accounting records of Omar Corporation contained

Q273: Angeloni Corporation uses a job-order costing system

Q368: Dehner Corporation uses a job-order costing system

Q371: Weakley Corporation uses a predetermined overhead rate