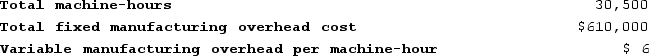

Lupo Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on machine-hours. The company based its predetermined overhead rate for the current year on the following data:  Recently, Job T687 was completed with the following characteristics:

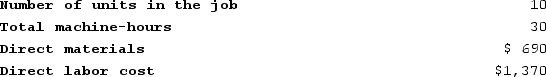

Recently, Job T687 was completed with the following characteristics: The total job cost for Job T687 is closest to: (Round your intermediate calculations to 2 decimal places.)

The total job cost for Job T687 is closest to: (Round your intermediate calculations to 2 decimal places.)

Definitions:

Corporate Philanthropy

Effort of an organization to make a contribution to the communities in which it earns profits.

Public Radio Station

A radio station that is funded by public means, such as government grants and listener donations, rather than commercial advertising.

Local Property Taxes

Taxes levied by local governments on real estate and sometimes other property, based on the assessed value of the property, used to fund public services and infrastructures.

EEOC (Equal Employment Opportunity Commission)

A federal agency that enforces laws against workplace discrimination and advocates for fair and equal employment opportunity.

Q7: Beans Corporation uses a job-order costing system

Q7: All of the following are examples of

Q23: Kroeker Corporation has two production departments, Milling

Q55: Verry Corporation uses a job-order costing system

Q139: Entry (1) in the below T-account represents

Q160: Karvel Corporation uses a predetermined overhead rate

Q255: The following costs were incurred in May:

Q286: Fasheh Corporation's relevant range of activity is

Q286: Sonneborn Corporation has two manufacturing departments--Molding and

Q304: Whether a company uses process costing or