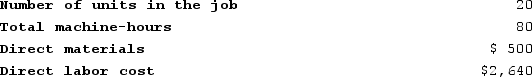

Levron Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on machine-hours. The company based its predetermined overhead rate for the current year on total fixed manufacturing overhead cost of $58,000, variable manufacturing overhead of $2.00 per machine-hour, and 20,000 machine-hours. The company has provided the following data concerning Job P978 which was recently completed:  The unit product cost for Job P978 is closest to: (Round your intermediate calculations to 2 decimal places.)

The unit product cost for Job P978 is closest to: (Round your intermediate calculations to 2 decimal places.)

Definitions:

Double Declining-Balance Depreciation

An accelerated depreciation method that double the rate of straight-line depreciation, decreasing the value of assets more quickly.

Accumulated Depreciation Balance

The total amount of depreciation that has been recorded against a fixed asset up to a specific point in time, reflecting the decline in the asset's value.

December 31

December 31 is traditionally the final day of the Gregorian calendar year, and it is often the fiscal year-end for organizations operating on a calendar year basis.

Straight-Line Depreciation

A method of allocating the cost of a tangible asset over its useful life in an equal and consistent manner.

Q31: During July at Loeb Corporation, $83,000 of

Q63: Which of the following production costs, if

Q81: Cai Corporation uses a job-order costing system

Q105: Janicki Corporation has two manufacturing departments--Machining and

Q171: The fixed portion of the cost of

Q181: Two of the reasons why manufacturing overhead

Q192: Lupo Corporation uses a job-order costing system

Q208: Job cost sheets contain entries for actual

Q260: The following data have been provided by

Q407: Feauto Manufacturing Corporation has a traditional costing